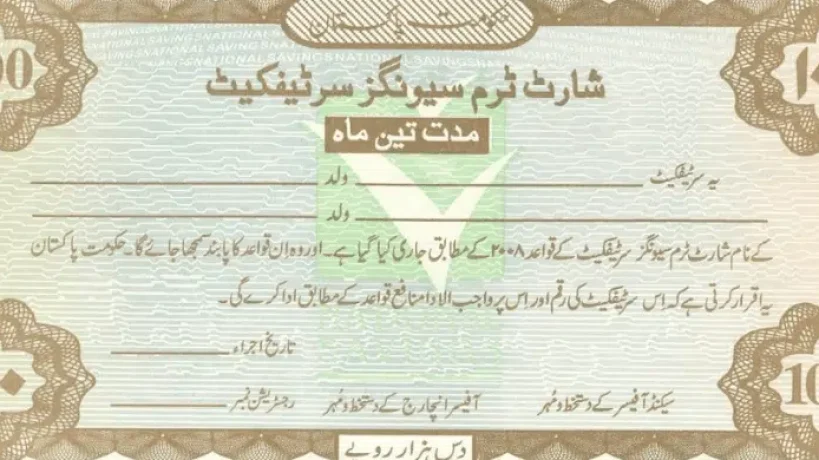

ISLAMABAD – Introduced in 2012, the Short-Term Savings Certificates (STSCs) program aims to cater to the short-term funding needs of investors, offering maturity periods of 3 months, 6 months, and 1 year. These certificates are pledgeable, allowing both Pakistani nationals and Overseas Pakistanis to invest.

Investors can start with a minimum deposit of Rs 10,000, with no upper limit set.

Updated Profit Rates for Short-Term Savings Certificates – September 2024

As of September 13, 2024, the Central Directorate of National Savings has adjusted the profit rates for the Short-Term Savings Certificates:

• 3-Month Maturity: The profit rate is now 18.52%, down from the previous rate of 19%.

• 6-Month Maturity: The rate has been revised to 18.22%, compared to the former rate of 18.92%.

• 1-Year Maturity: Qaumi Bachat Bank has decreased the profit rate to 17.22%, from the earlier 17.9%.

Tax Deduction on Profit Rates

Tax rates on the profit from these certificates are as follows:

• Filers: Individuals listed in the Active Taxpayer List (ATL) will have a withholding tax rate of 15% on their yield/profit, regardless of the investment date or amount.

• Non-Filers: Individuals not listed in the ATL will incur a withholding tax rate of 30% on their yield/profit, regardless of the investment date or amount.

Investors are advised to consider these updated rates and tax implications when planning their investments.